The true value of GameStop

A group of internet investors, including some at the school, have attempted to reverse the initiatives of hedge funds and short-sellers.

media by Matthew Fink

Wall Street was shocked when a group of internet investors took over the stocks of declining companies like GameStop and AMC.

February 5, 2021

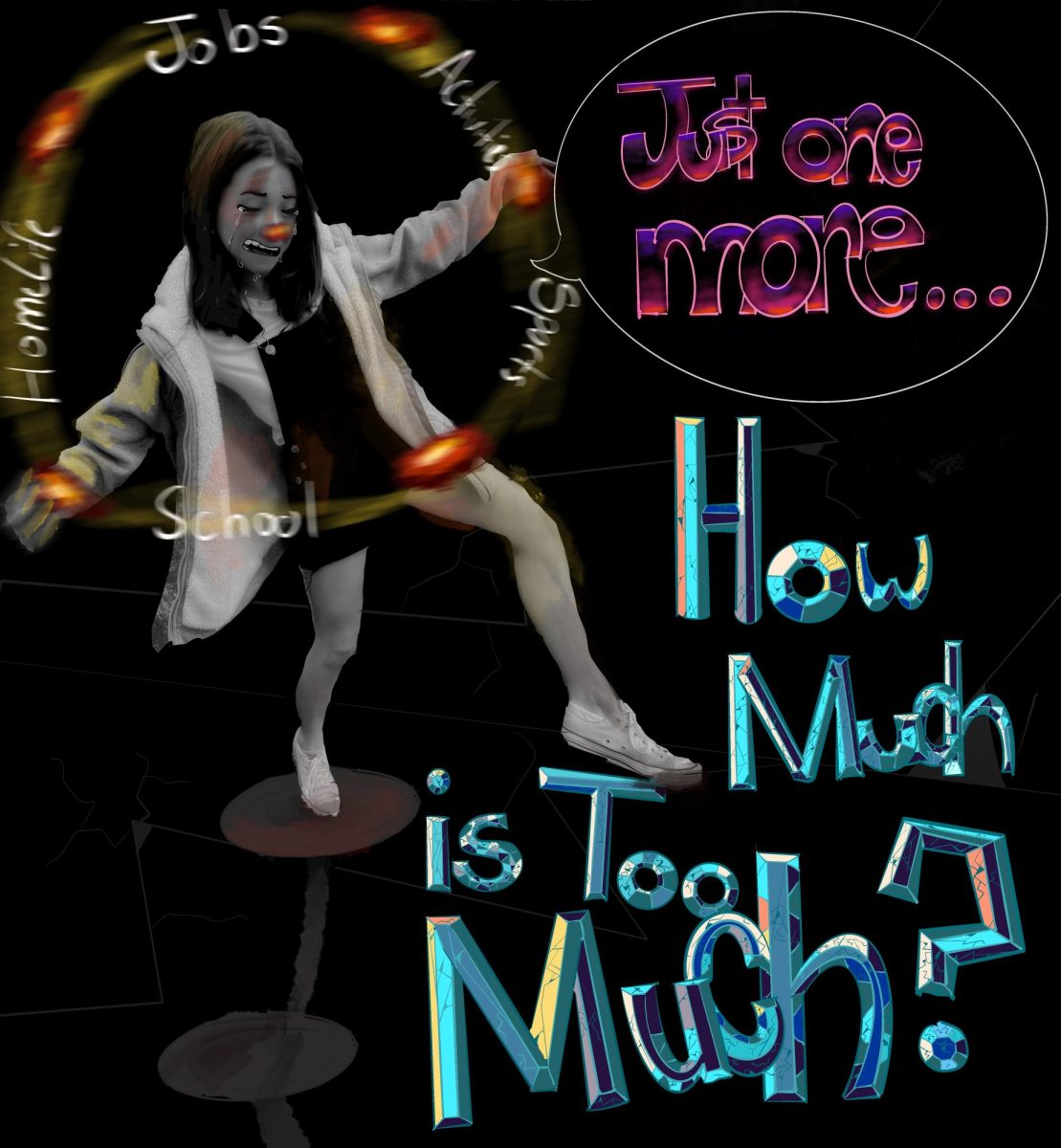

One student, Mitchell Kubina ‘22, has lost over 50% of his investment in GameStop from when he initially invested in the company. He and thousands of other people on the internet are investing money into GameStop, not for monetary profit, but to send a message.

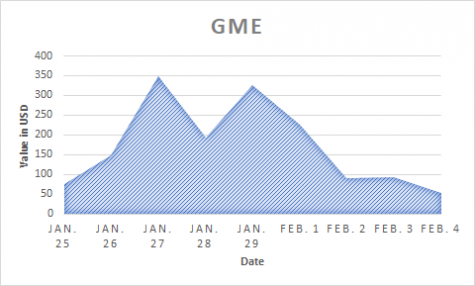

GameStop started the year with a worth of 1.3 billion dollars and climbed to 21 billion dollars by the end of last week, with a value increase of about 20 billion dollars. That money has been redirected from the hand of hedge funds to a group of people on Reddit, a social media platform that acquaints users with people with similar interests to their own, such as video games, tv shows, or in this case, money.

Since its founding in 1984, GameStop has been selling hard copy games for millions of people, and it grew to be one of the biggest companies in gaming. GameStop reached its prime in the late 2000s and since then has been on a fairly steady decline bringing us to today. The main reason for this is because of the rise of online shopping. Games no longer have to be bought in-store and can be bought from the leisure of your own home. This is incredibly similar to the downfall of Blockbuster, which went out of business because of the growing popularity of online streaming services like Netflix and Hulu. This growing popularity in buying games online has nearly guaranteed that GameStop would go out of business eventually, and this is what many hedge fund owners predicted would happen, resulting in the short squeeze of GameStop.

What is short squeezing? What is a hedge fund? And what happened to allow all of this? To start, the current stock market has a special sort of liquidity to it, meaning that stocks are constantly being redirected from company to company, and the value of a stock is always going from person to person. So when it became painfully aware to many people that GameStop was a failing company, these groups called hedge funds started to sell their stocks in mass to maximize profits for their investors.

A hedge fund is a middleman of sort: they will offer an option to any willing investors to either bet their money on a stock going up (otherwise known as a call) or to bet their money on the stock going down (otherwise known as a sell).

This process of hedge funds selling their stocks at once is called short squeezing (shorting). Shorting involves the middle-man (the hedge funds) selling a stock at a certain value, which in turn decreases the value of said stock. Then, the middle-man buys the same stock at a lower price, making a profit.

Example: Originally: 1 stock = $100. The traders sell those stocks, decreasing the value. Now, 1 stock = $20. This difference in price provides an $80 profit for the middle-man and the original investor. The middle-man will take a bit of that profit and return the rest to the investor.

The other aspect to understand about the situation is who caused this insane growth in GameStop. This falls to an internet community on the social media platform Reddit called r/wallstreetbets. Wall Street Bets is notorious for trying to take advantage of the stock market. A prime example of this was in 2019 when one user, u/1R0NYMAN, turned a $3000 investment into a $50000 loss, because they thought they found a way to exploit Robinhood for money… clearly not.

“What they do is use the stock market as a casino, [u/1R0NYMAN] took a risk, and it ended up costing him; sometimes you win and sometimes you lose,” Andrew Dupper ‘22 said.

Until recently, r/wallstreetbets has had a fairly large amount of members but has only had a small impact on the stock market with most interesting events happening on a tiny scale. That all changed when the community noticed that the short squeeze was happening. While it was a community inspired thing, and no single person can be attributed for this, much of the recognition can go to Keith Gill, known on Reddit as u/DeepF—ingValue. He had been “yolo-investing,” investing large amounts of money just to see what happens, in GameStop since last year. His decision to hold his already incredible amount of earnings from the past year throughout the short squeeze inspired many other people to join him in his “yolo-investment,” eventually bringing the GameStop stock way past its original value.

There were two clear motives for this. The first being that many people saw this as a chance to get rich quickly and many people were able to get large amounts of money out of this. But the other reason is that people wanted to send a message to the incredibly wealthy that the average person still has a say in the stock market. These motives have even reached high school students, such as Kubina.

“You see the price go up, and you go ‘wow,’” Kubina said. “So I checked out the subreddit [r/wallstreetbets] and people were predicting that it would go up more, so I bought.”

Over the past week, GameStop has had very dramatic shifts in stock value. What initially started as a massive decrease in value due to short-selling turned into a massive increase because of r/wallstreetbets, ending with major stock-trading platforms like Robinhood halting trading and ultimately bringing the value back down.

Alongside GameStop, this influx in investments has influenced the stock of other companies as well, and many of these companies have also been on the decline for a while. One of these companies has been the movie theater company AMC. AMC experienced similar growth from this surge as GameStop did, however not on the same scale. As of now, all of these stocks are on the decline as people have started to sell. This was partially as a result of the tendency for people to sell once they have made a profit but also as a result of Robinhood stopping trading temporarily, which encouraged many to sell before the price went too low.

“The people who are smarter have already taken their stocks out, so they are just leaving the people who believe it will go up without any money,” Tripp Thompson ’22 said.

More interestingly, two other stocks have been invested in as a result of the recent events: silver and DogeCoin. The stock of silver (yes, the metal) was sent to an eight-year high due to comments on r/wallstreetbets that claimed that silver prices were being artificially lowered, resulting in a dramatic surge of investments into the metal. DogeCoin, which started as a joke cryptocurrency revolving around the early meme, Doge, has had several spikes for various reasons over the past couple of years, the most relevant before the GameStop events being when Elon Musk tweeted out encouraging people to invest in DogeCoin in late 2020.

New investors have once again been putting money into DogeCoin with hopes of bringing it to the value of one dollar. As of Feb. 4, the value of DogeCoin is about $0.05. These investors still have a long way to go if they want it to reach a dollar.

“I don’t think DogeCoin will reach a dollar because the meme will get stale before it reaches a dollar– it will lose relevance.” DJ Crawford, Rock Canyon alumni said.

However, although many people have already sold, many people are still holding in companies like GameStop and AMC. The first motive of making cash quickly has almost been eliminated, and now people are holding their investments strictly for the purpose of sending a message to the hedge funds and short-sellers.

“I do not regret investing my money because I am confident that it will go up and that the short sellers will not be able to deflate the stocks forever,” Ryan Livingston ‘22 said. “Hold forever.”

The future of these stocks is uncertain. If the trend dies out, then it most certainly means the end of some of these companies, especially GameStop. This is because people will likely keep selling until the stock hits an unsustainable level. On the other hand, if people like Kubina, who said he “still [has] hopes for [his GameStop investment and is] still feeling good,” hold their funds in these companies then maybe GameStop and other companies can sustain themselves in the future, and the internet investors can successfully send their message.

![Minutes before the Activities Fair in the gym, president Abhi Gowda ‘26 prepares the stall for his club Helping Hands, Sept. 4. A relatively new club, Helping Hands was co-started by Gowda and focuses on assisting the homeless, and just last year they succeeded in raising a couple hundred donations to send to shelters. This year, they have goals to expand, with hopes to increase volunteer opportunities and take in-person trips to shelters, as well as extend their help beyond just homeless people. “The Activities Fair gives a lot of underclassmen the opportunity to really get to know the Canyon culture, and it gives them many opportunities for service and volunteering,” Gowda said. “[Through the Activities Fair,] I hope to find a bunch of new and passionate members about our club and just get our name out there and spread awareness to the cause that we’re fighting for.”](https://rockmediaonline.org/wp-content/uploads/2025/09/1-2-1200x885.jpg)

![The winter guard team makes fifth place at the state championship finals in the Denver Coliseum, March 30. The team performed to Barnes Country's “Glitter and Gold,” lead by coaches Margo Sanford, Blair Bickerton and Anna Orgren. In their class there were a total of nine groups participating, and the top five who made it to finals received a plaque. “[Walking onto the stage] is very nerve-wracking, but also very exciting as well. When you first start color guard there's a lot of anxiety and uncertainty when you first perform in front of an audience, but once you've done it for a while, it starts to become the best part of the season,” Ella West ‘25 said. “It's very fulfilling to see an audience react to something you've put your heart and soul into.”](https://rockmediaonline.org/wp-content/uploads/2025/04/Both-socal-media-nd-website-main-1-1200x846.jpg)

![April marks the 25th anniversary of Sexual Assault Awareness Month, created by the National Sexual Violence Resource Center (NSVRC). This month is to spread awareness of the harassment, assault and abuse that happens around the world. The symbol that represented the month was a teal ribbon; however, some survivors of assault create different symbols and movements like the TikTok trend in 2022, where survivors would tattoo Medusa on their body, in honor of her backstory in Greek Mythology. “I don't think [this month is known] at all. I rarely see anybody talk about it. I rarely see much of an emphasis on posting it online, or much discussion about it, and I feel like there needs to be way more discussion,” an anonymous source said. “I think just validating every experience that a person has gone through, regardless of the degree of it, the severity, is an essential step into making sure that people are aware that this is a very real problem in a society and that we need to do better in addressing it.”](https://rockmediaonline.org/wp-content/uploads/2025/04/IMG_0011-1200x900.jpg)

![Lesbian Visibility Day is April 26, and it’s a holiday to celebrate the lesbian community of the world. Lesbian Visibility day was established in 2008 by many queer activists and organizations who sought to raise more awareness for lesbian history and culture. “So this is why during Lesbian Visibility [Day] we celebrate and center all lesbians, both cis and trans, while also showing solidarity with all LGBTQ+ women and nonbinary people,” Linda Reily, in an article written by her, said.](https://rockmediaonline.org/wp-content/uploads/2025/04/Lesbian-Visibility-day.jpeg)